QUESTION:

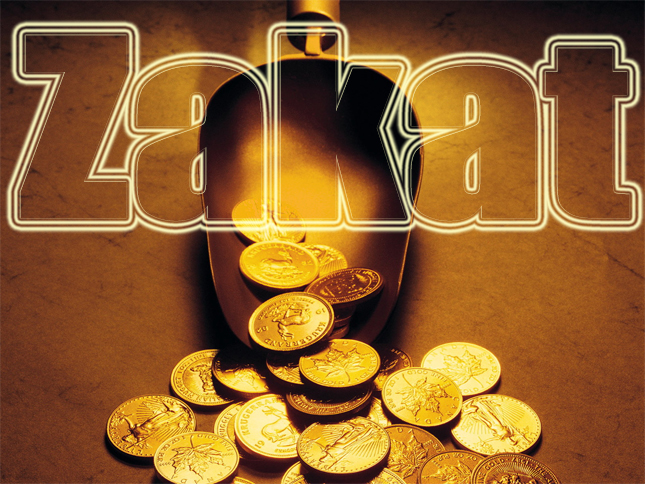

What do the noble ulamā say regarding this that nowadays which nisāb value is should be considered concerning the Zakāt of Currency and Stock Merchandise? Will the Gold nisāb be considered or the Silver nisāb? Whereas nowadays trade is considered relative to Gold and Currency is also considered as following on from Gold, in such a scenario what will consideration be given to?

ANSWER:

بسم اللہ الرحمن الرحیم

الجواب بعون الملک الوھاب اللھم ھدایۃ الحق والصواب

Whosoever possesses currency or stock merchandise, surplus to his basic needs, for a lunar year, equal to the value of 52.5 tolas of Silver (approximately 612.35 grammes) Zakāt is obligatory upon him.

The nisāb that is given considered in relation to Currency and Stock merchandise is not the Gold nisāb, rather it is the Silver nisāb because when considering the nisāb the basis is set upon that thing in which there is benefit for the poor and that is in the nisāb for Silver. This is why the nisāb for Silver has been made the measure. Placing these wisdoms at the forefront our noble fuqahā (jurists) have been issuing the fatwā upon this through the ages. Therefore, in the scenario asked about the consideration will be given to the nisāb for silver as is related in the general texts of the Hanafī Madhab.

الله أعلم عز و جل و رسوله أعلم صلى الله تعالى عليه وآله و سلم

Answered by Muhammad Sajjād al-Attārī al-Madanī (Specialist in al-Fiqh al-Islāmī) – 18h Safar 1430 AH

Attested by: Muftī Fudayl Ridā al-Attārī

Translated by Ustādh Ibrar Shafi

Source: Dār al-Iftā Ahl al-Sunnah (Da’wat e Islami)

Read the original Urdu answer here: [Q-ID0685] When calculating Zakah on cash and stock merchandise, should the Nisab of Silver or Gold be taken into account?

![[Q-ID0207] I’ve not paid Zakah for many years, how shall I pay now?](http://www.seekerspath.co.uk/wp-content/themes/hueman-pro/assets/front/img/thumb-medium-empty.png.pagespeed.ce.q0RS_Oe2Ar.png)